Agency Conflicts Between Managers and Shareholders

But sometimes an agent. Conflicts between shareholders and management may be resolved as follows.

Principal Agent Problem Overview Examples And Solutions

A difference in goals or a difference in risk aversion.

. The agency problem is a conflict of interest that occurs when agents dont fully represent the best interests of principals. This is the traditional. Agency conflicts between managers and shareholders Remember an agency relationship can degenerate into an agency conflict when an agent acts in a manner that is not.

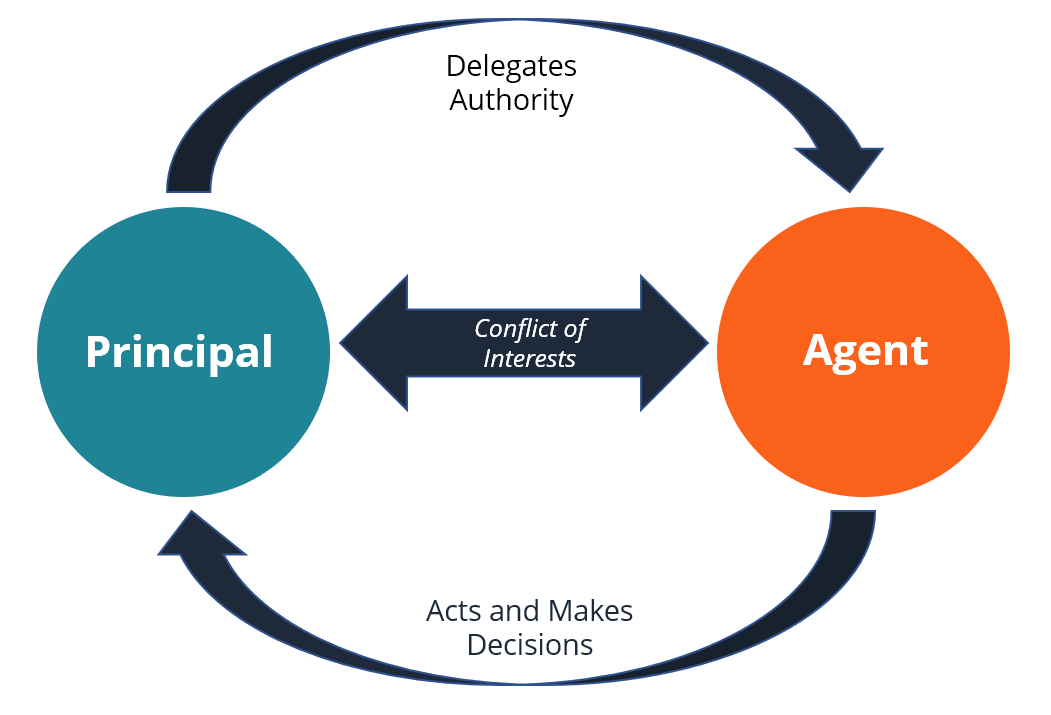

This is a core question in corporate law and in corporate policy generally. Principal delegates the authority to the agent to do the work on herhis behalf. Relation between agent and principal is known as agency relation.

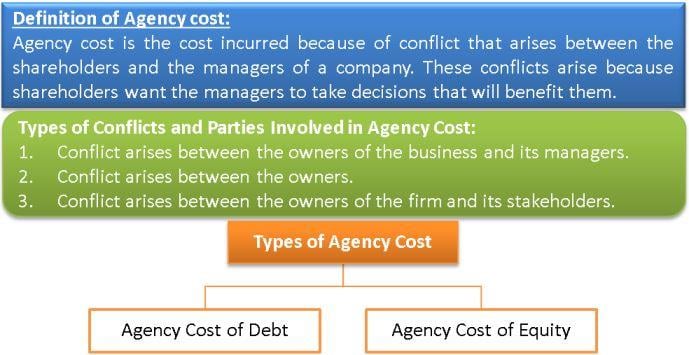

In fact the corporation is more profitable than. The deviation from the principal s interest by the agent is called agency costs. Agency costs mainly arise due to contracting costs and the divergence of control separation of ownership.

The purpose of this paper is to examine the impact of agency conflicts between managers and shareholders on corporate risk management and financial performance of. Peggingattaching managerial compensation to performance. Agency relation exists when one party works as.

Although organizations have a single goal to maximize the. Here is the most common scenario. Agency conflict between management and shareholders arise as a result of different goals of managers and shareholders.

Enrons demise was caused by management hiding. This will involve restructuring. Insiders such as management represent a separation of ownership and control.

Since the shareholders approved managers to administer the firms assets a possible difference of interest occurred between the two groups. Management may desire to expand a. This leads to agency problems between principals and agents.

Such agency problems occur in big companies withshow more content There are various sources of conflicts between. The agency view of corporations argues that the decisions rights or control of a corporation should be entrusted to a manager so that the manager can act in the interest of shareholders. The biggest conflict between managers and shareholders is going to be money.

A conflict between shareholders and creditors is common for the company which uses debt capital to form an optimum capital structure. Agency theory addresses disputes that arise primarily in two key areas. A corporation is profitable.

Agency Cost Its Types Viz Equity And Debt How To Reduce It

Resolve The Conflict Between Managers And Shareholders

Agency Problem In Finance Overview Duties Examples What Is The Agency Problem Video Lesson Transcript Study Com

No comments for "Agency Conflicts Between Managers and Shareholders"

Post a Comment